AI for the banks of tomorrow.

Risk is

Your banking platform should be too.

Establishing a new compliance paradigm.

AI, meet banking.

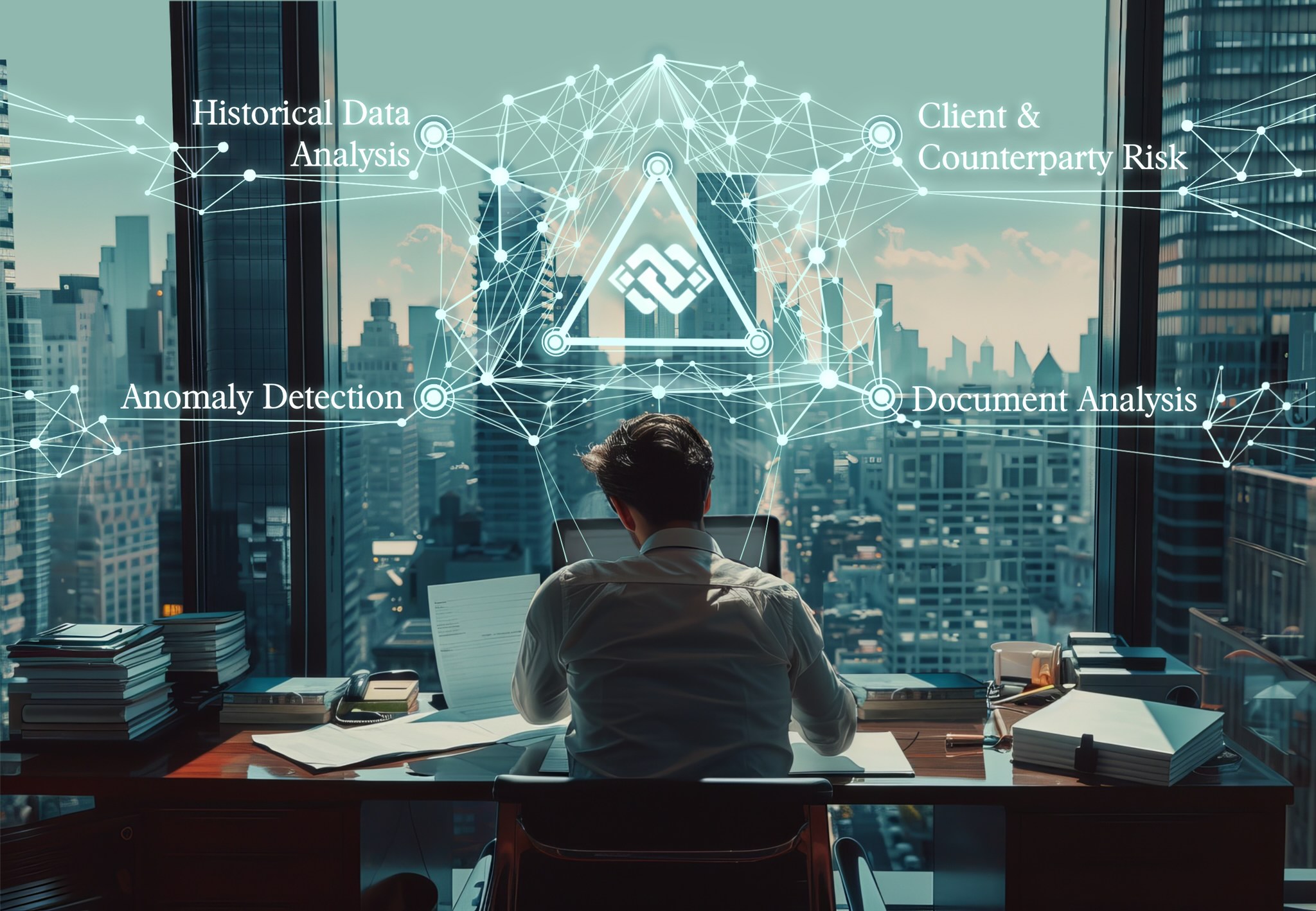

PointChain develops AI solutions enabling Banks ability to assess, identify, and address risk in real time.

Legacy tools are reactive and manual, providing insights after an issue or risk trigger has already occurred.